Federal Student Aid is the largest provider of financial aid for college in the U.S. Understand aid, apply for aid, and manage your student loans today. To access your Federal Student Aid (FSA) information and apply for financial aid, you need to log in from the button below.

The FAFSA Login is your gateway to important resources. You can check your FSA application status, update personal info, and manage aid offers there. Logging in is pretty straightforward. You use your FSA ID—the username and password you set up when you signed up.

Attention

If you forget your info, the site has steps to help you recover your account. This login keeps your information safe so only you can manage your financial aid.

Understanding FAFSA Login

You need secure access to the online system to apply for federal student aid. Using the right login details lets you review your information and manage your application.

What Is a FAFSA Login?

Your FAFSA login is the unique way you access the Free Application for Federal Student Aid online. It’s also called your FSA ID.

This includes a username and password you create when you set up your account. You use your FAFSA login to start, complete, or update your financial aid application.

It also lets you sign your FAFSA electronically and check your application status whenever you want. Secure access here helps protect your personal and financial info.

Whenever you visit the FAFSA website or the Federal Student Aid portal, you enter your FSA ID to see your records. You’ll need this same login for signing loan agreements and tracking your progress through the aid process.

Importance of FAFSA Login

You need a FAFSA login if you want to submit your financial aid application online. Without it, you can’t fill out or sign the application, and you can’t access your federal student aid records.

Your FAFSA login allows you to:

- Apply for federal grants, work-study, and student loans

- Check your aid eligibility and application status

- Correct or update your FAFSA form

- Access loan information and sign required agreements

If you forget your login, you might run into delays or miss out on applying. For privacy and safety, don’t share your login with anyone else.

Your login keeps your data and documents secure.

Eligible Users

If you plan to apply for federal student aid, you’re eligible to create a FAFSA login. This includes U.S. citizens, permanent residents, and some eligible non-citizens—like certain refugees or those with asylum or parolee status.

High school seniors, GED holders, and college students can all make an account. If you’re a dependent student, your parent or legal guardian may also need their own FSA ID to sign your application.

Only one FSA ID per person, please. Use your own email and phone number so you keep access to your account throughout the process.

Creating and Managing Your FSA ID

Your FSA ID is your username and password for Federal Student Aid. You’ll use it to access, complete, and manage your FAFSA, view loan details, and sign legal documents securely.

How to Create an FSA ID

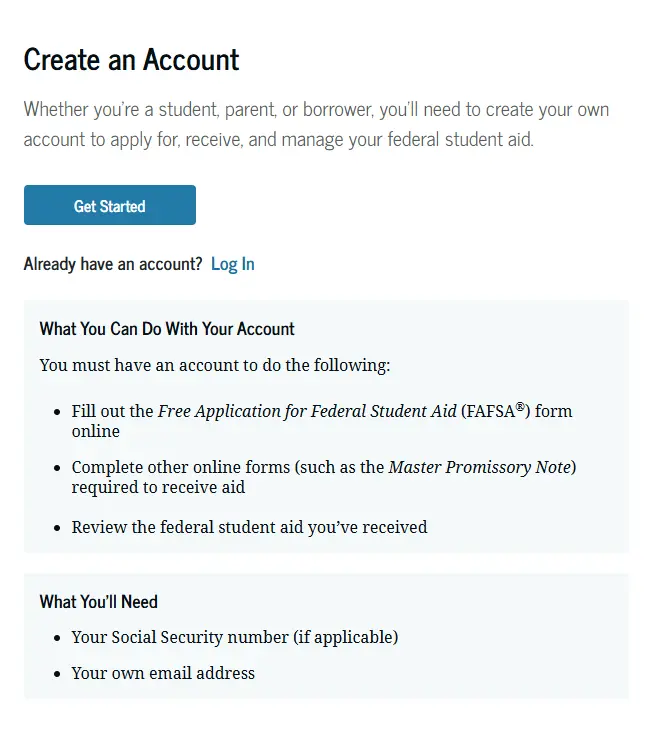

Head to the official StudentAid.gov website to create your FSA ID.

Click “Create Account” You’ll need a valid email, your full name, date of birth, and Social Security number. Make sure all info matches your official documents.

You’ll set up a unique username and password. Pick security questions to help if you forget your login later. Use a strong password for safety.

Double-check your info before you submit. After you create your FSA ID, check your email to verify your account. Once you verify, your FSA ID is ready for all U.S. Department of Education websites.

Resetting Your FSA ID Password

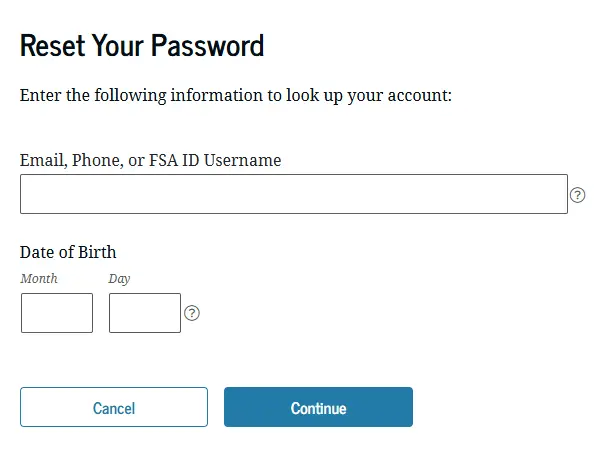

If you forget your FSA ID password, you can reset it online.

Go to StudentAid.gov and click “Log In.” Then pick “Forgot My Password?” Enter your username or verified email address. You might need to answer security questions or get a code by email or text.

Follow the steps to set a new password. Make it different from your old ones. After you reset, you can log in with your new password.

Keep your password private. Don’t share your FSA ID or password with anyone. Each person needs their own FSA ID, including parents of dependent students.

Updating Account Information

It’s important to keep your FSA ID info current. To update your email, mailing address, or phone number, log in at StudentAid.gov. Edit your info in your account settings.

If you change your name or Social Security number, update these with the Social Security Administration first. Your FSA ID profile should always match your legal records to avoid headaches.

Save any changes after you edit. Make sure your email and phone are accurate so you get updates from the U.S. Department of Education.

Accessing the FAFSA Application

To apply for federal financial aid, log in to the FAFSA website using your FSA ID. If you forget your login, there are ways to recover or reset your info.

Logging in to Complete the Application

You must have an FSA ID to log in and fill out the FAFSA form. The FSA ID is your username and password for signing your application online.

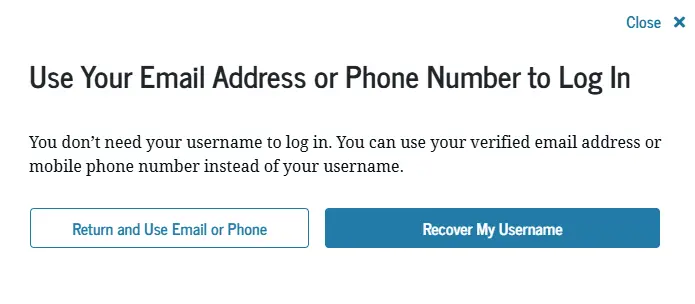

You use the same FSA ID every year and for different federal student aid tasks. Go to the FAFSA website to start your application. Click “Start Here” if you’re new, or “Log In” if you already have an account.

Enter your FSA ID to reach your dashboard. Parents of dependent students need their own FSA ID to sign. Keep your login details safe—don’t share them.

If you are a resident of New York, you should check the process of TAP application.

Retrieving or Recovering Login Credentials

If you forget your username or password, use the “Forgot My Username” or “Forgot My Password” links on the login page. You can reset your FSA ID using your email, mobile, or by answering security questions.

Here’s what to do:

- Click the right “Forgot” link.

- Enter your info as prompted.

- Check your email or phone for a verification code.

- Create a new password if needed.

If you can’t access your email or phone, answer your security questions to recover your account. For extra help, contact Federal Student Aid support. Guard your FSA ID to avoid delays in your application.

Common FAFSA Login Issues and Troubleshooting

Lots of people run into problems logging into their FAFSA account. The most common issues are account lockouts and technical problems with browsers or devices.

Account Lockouts and Security

If you enter the wrong username or password too many times, your account might get locked. This helps protect your info. Use your correct FSA ID every time you sign in.

If you’re not sure you typed the right FSA ID, double-check your username and password. Sometimes parents and students mix up their credentials. Make sure you’re using your own FSA ID.

If your account is locked, follow the recovery steps. You may need your verified email or phone to reset your password. If you can’t reset your account, contact StudentAid.gov support for help.

Browser and Technical Requirements

The FAFSA website doesn’t always work on every browser or device. Some features might not load if you’re using an outdated browser, or if your browser needs an update.

Clear your browser’s cache and cookies if you have trouble loading pages or logging in. Try a different browser—Chrome, Firefox, or Edge—if you’re still stuck.

Some security settings or browser extensions can block parts of the FAFSA site. If you run into issues, try turning off extensions or use a private browsing window. A stable internet connection helps too.

FAFSA Login for Different Aid Years

When you log in to complete, review, or update your FAFSA, you need to know which aid year you want. Each aid year affects the financial details you enter and the award info you’ll see.

Selecting the Correct Aid Year

The FAFSA links to specific aid years, like 2024-2025 or 2025-2026. When you log in, pick the right aid year for the school year you need financial help.

You’ll see a drop-down menu or list of aid years on your dashboard. Double-check the aid year before starting or updating your application. If you plan to attend college in fall 2025, select the 2025-2026 aid year.

Picking the wrong aid year can cause incomplete applications or missing out on the right awards. Check your school’s deadlines and the FAFSA opening dates for your situation.

Viewing Previous and Current Applications

After logging in, you can see your current application and earlier ones from past years. This helps you track awards, compare aid, and check any updates or changes you made.

Find links or tabs by each aid year, usually listed by date. Pick the aid year you want to review. You can see statuses, corrections, and award breakdowns for each year.

This makes it easier to update details or share info with your school. If you need to reference past data, access these records through your StudentAid.gov account.

Linking FAFSA Login with Financial Aid Resources

When you use your FAFSA login, you unlock key college funding options. By logging in, you connect directly with school financial aid offices and sometimes other aid applications, like WASFA in certain states.

Connecting to College Financial Aid Offices

Your FAFSA login lets you send your application results to different colleges. College financial aid offices use this info to decide if you qualify for grants, loans, or scholarships at their school.

If you need help or have questions, these offices can check your FAFSA records once you give permission. You can follow up with them about missing documents, deadlines, or awards. Most schools have online portals, and you might need your FAFSA details to access certain results or forms.

Here’s how you can connect your FAFSA with campus aid services:

- Send your FAFSA to multiple colleges directly through the application page.

- Contact the financial aid office at your school if you notice issues or need guidance.

- Use your FSA ID when logging in to check aid status or provide updates to the college.

FAFSA Login for State and Non-Federal Aid (e.g., WASFA)

Some states offer financial aid for students who might not qualify for federal help. WASFA is the Washington Application for State Financial Aid. Sometimes, you’ll need info from your FAFSA before applying for state programs.

You usually use your FAFSA login to review or print your application results for state agencies or other programs. Some states link their aid process with FAFSA. Others, like WASFA, have a separate application but still use similar questions and your FAFSA details when possible.

Read your state’s aid office rules. If you’re applying for WASFA, don’t submit a FAFSA if you’re not eligible—a common mistake. Double-check requirements so you use the right login or forms.

Information Required for FAFSA Login

To log in to the FAFSA website, you’ll need specific personal info and documents. These details help verify your identity and let you access or submit your financial aid application securely.

Personal Identification and Security Details

You’ll need your FSA ID. That’s the username and password you set up at the Federal Student Aid website. Your FSA ID lets you log in, sign your FAFSA, and get into your account dashboard.

Have your full legal name, Social Security number, and date of birth handy. Email addresses matter for account verification and password resets. If you’re a dependent student, you’ll probably need a parent’s Social Security number or their FSA ID to finish logging in or signing the form.

Keep this info private. Don’t share your FSA ID with anyone, even family—it puts your personal data at risk. Write down your login details and stash them somewhere safe. Seriously, losing access can be a headache.

Tax and Income Information

You don’t need tax forms just to log in, but once you’re in, you’ll need accurate financial info to finish the FAFSA. That means tax returns, W-2s, and any records of untaxed income.

You’ll have to give details for the most recent tax year, like your Adjusted Gross Income (AGI) and your assets. Dependent students will need their parents’ financial info, too.

Having this stuff ready makes filling out the FAFSA way less stressful.

Managing and Monitoring Financial Aid Status

Keeping an eye on your financial aid is key. You want to know when funds are coming and what you’re actually eligible for.

Check your account often so you don’t miss updates about your aid package or payments.

Checking Financial Aid Status and Payment

Log into your Federal Student Aid (FSA) account to see your financial aid status. Once you’re in, you’ll find details about your applications, loans, and grants.

This helps you track your progress and see if you need to take any extra steps. You can also check payment and disbursement status right from your dashboard.

Some colleges use services like BankMobile Disbursements to send funds to your bank or a card. Make sure you know your school’s disbursement method so you’re not left wondering where your money is.

If something seems off or delayed, reach out to your school’s financial aid office or check the FSA website.

Award Notifications and Communications

You’ll get notifications about financial aid awards by email or through your FSA account. These messages tell you if you’ve got a grant, loan, or work-study offer.

Read them carefully—they include important details about your award information.

Colleges also send updates through their student portals, so check both your FSA account and school email regularly. Deadlines and next steps are often buried in these communications.

If you’re confused by something in your award letter, just ask your school’s financial aid office. It’s better to ask than miss out on aid you deserve.

Impact of FAFSA Login on Federal and Institutional Aid

Logging into your FAFSA account gives you access to the financial aid that helps pay for college. You use your FAFSA login to check federal grants, apply for loans, review scholarships, and see work-study or student employment programs.

Grants, Loans, and Scholarships Eligibility

Once you log in, you can see if you’re eligible for federal and state grants like the Pell Grant. If you qualify, the system shows you these awards and amounts.

Federal loans—Direct Subsidized and Unsubsidized—are managed in your account. You can check your loan options, loan history, and repayment plans.

Colleges use your FAFSA data to offer institutional scholarships and need-based aid. Keeping your FAFSA info accurate and checking your account often helps you avoid missing deadlines or fixes.

Work-Study and Student Employment Programs

Your FAFSA login also opens doors to work-study opportunities. Work-study lets you earn money for school by working part-time while you’re enrolled.

In your account, you can confirm if you’ve been offered federal work-study, check out job matches, and track your hours or earnings. Some schools use FAFSA data to offer their own student jobs.

Log in regularly to keep your job eligibility up to date. That way, you don’t miss campus jobs tied to financial aid.

Student Aid Index, Eligibility, and Satisfactory Academic Progress

To get federal student aid, you’ve got to meet a few requirements—financial need, academic progress, and submitting the FAFSA each year. The Student Aid Index (SAI) and Satisfactory Academic Progress rules help decide if you’ll get or keep your aid.

Understanding Student Aid Index (SAI)

The Student Aid Index (SAI) is a number that shows how much your family can pitch in for your education. It’s calculated from what you put on your FAFSA.

Colleges use this number to figure out how much help you might get. A lower SAI usually means you could qualify for more aid, while a higher one might cut what you get.

SAI replaced the old Expected Family Contribution (EFC). Both serve a similar purpose, but SAI is supposed to be easier to understand. Your SAI depends on your family’s income, assets, and other FAFSA info.

Satisfactory Academic Progress Requirements

Satisfactory Academic Progress (SAP) means you have to keep up your grades and finish enough classes to keep your federal student aid. Schools check your SAP every year or term, depending on their rules.

There are three main SAP standards:

- GPA Requirement: Keep a minimum GPA (usually around 2.0).

- Completion Rate: Finish a certain percentage of your classes (often at least 67%).

- Maximum Timeframe: Complete your degree within a set number of attempted credits.

If you lose aid because of SAP, you might be able to appeal or get it back by improving your grades and completing courses. Always check your school’s SAP policy—rules can be different everywhere.

FAFSA Login and Educational Expenses

When you log in to the FAFSA website, you can see your financial aid info and estimate how much help you might get. Understanding your cost of attendance and expenses helps you make a plan for covering college costs.

Cost of Attendance Considerations

The cost of attendance (COA) covers tuition, fees, room and board, books, supplies, and other required costs. With your FAFSA login, you can see how your aid package stacks up against your school’s COA.

Most schools give you a breakdown of costs in your financial aid award letter. Here’s a typical list:

| Category | Typical Costs |

|---|---|

| Tuition & Fees | $5,000 – $50,000 per year |

| Room & Board | $8,000 – $12,000 per year |

| Books & Supplies | $1,200 – $1,500 per year |

| Personal Expenses | $2,000 – $3,000 per year |

You can also see your expected family contribution and available federal aid. Knowing these numbers helps you budget and avoid nasty surprises.

Managing Living and Educational Expenses

FAFSA aid might not cover everything. You might need to find other ways to pay for living costs like food, transportation, or off-campus housing.

Lots of students use a mix of federal grants, loans, scholarships, and savings. Some rely on credit or part-time jobs to fill the gaps.

Try to track your expenses and stick to a budget so you don’t run out of cash mid-semester. Separate your educational expenses (tuition, books) from your living expenses (groceries, rent).

Some schools offer tools or workshops to help you manage money. Log in to your FAFSA and school accounts often to keep your finances on track.

Special Grant Programs Accessed Through FAFSA Login

Some grant programs use your FAFSA login for eligibility. These programs offer extra help if you have specific financial needs.

Federal Supplemental Educational Opportunity Grant (SEOG)

The Federal Supplemental Educational Opportunity Grant (SEOG) gives extra help to students with serious financial need. If you’re an undergrad with a low Expected Family Contribution (EFC), you might qualify.

Not every school participates in SEOG. Fill out the FAFSA as early as you can—schools have limited SEOG funds each year. The amount ranges from $100 to $4,000 per year.

Your school decides if you get SEOG and how much. You don’t have to pay it back. To check eligibility, log in to your FAFSA account and look for updates from your school’s financial aid office.

Frequently Asked Questions

If you need to access your FAFSA account, reset your login, or correct info, there are steps you can take. Deadlines and support options matter, too.